Rachel Springall, Finance Expert at Moneyfacts, said:

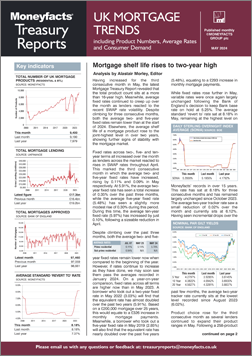

“Mortgage rate rises have gained pace, with the average two- and five-year fixed rates increasing by 0.11% and 0.09% respectively, the biggest month-on-month jump since March 2024. This counters the more subdued rises seen a month prior, so rates are closing in to levels not seen since the start of the year. Volatile swap rates spurred lenders to review their fixed mortgage pricing, which has resulted in rises across all loan-to-value tiers on two- and five-year fixed mortgages. Borrowers may be concerned by these movements, but one positive point to take from the latest trends is that mortgage shelf-life has stabilised to 28 days. Despite lenders pulling selected fixed deals, some of which were priced below 5%, there was not a mass exit of products. It was evident that repricing during April was the clear focus among lenders, and in fact, mortgage product availability rose.

“As reported last month, overall product availability is at its highest point in over 16 years, and another month-on-month growth, of 258 deals, is positive to see this month, but it fell short of the bumper 303 rise recorded the month prior. This thriving product availability is widespread across the underlining loan-to-value tiers, including those at 90% and 95%, so lenders are still improving choice for those with limited deposits or equity. Overall, there are more five-year fixed rate mortgages than two-year deals, and as has been the case since October 2022, the average five-year fixed rate remains lower than its two-year equivalent. However, the rate gap stands at 0.43% this month, the biggest for six months (November 2023 – 0.43%).

“Borrowers coming off a fixed rate mortgage this year will need to cover higher monthly mortgage repayments. Indeed, in May 2022, the average two-year fixed mortgage rate was 3.03%, and in May 2019 the average five-year fixed mortgage rate was 2.85%. It will still be cheaper for borrowers to grab a fixed mortgage now compared to sitting on a revert rate, based on average rates, and some borrowers may even consider a base rate tracker mortgage over the next two years if they are in line with economists’ predictions for the Bank of England to cut base rate this year. Consumers preparing to refinance or ready to buy their first home would be wise to seek advice to navigate the latest deals available.”

Rachel Springall, Finance Expert at Moneyfacts, said:

“Mortgage rate rises have gained pace, with the average two- and five-year fixed rates increasing by 0.11% and 0.09% respectively, the biggest month-on-month jump since March 2024. This counters the more subdued rises seen a month prior, so rates are closing in to levels not seen since the start of the year. Volatile swap rates spurred lenders to review their fixed mortgage pricing, which has resulted in rises across all loan-to-value tiers on two- and five-year fixed mortgages. Borrowers may be concerned by these movements, but one positive point to take from the latest trends is that mortgage shelf-life has stabilised to 28 days. Despite lenders pulling selected fixed deals, some of which were priced below 5%, there was not a mass exit of products. It was evident that repricing during April was the clear focus among lenders, and in fact, mortgage product availability rose.

“As reported last month, overall product availability is at its highest point in over 16 years, and another month-on-month growth, of 258 deals, is positive to see this month, but it fell short of the bumper 303 rise recorded the month prior. This thriving product availability is widespread across the underlining loan-to-value tiers, including those at 90% and 95%, so lenders are still improving choice for those with limited deposits or equity. Overall, there are more five-year fixed rate mortgages than two-year deals, and as has been the case since October 2022, the average five-year fixed rate remains lower than its two-year equivalent. However, the rate gap stands at 0.43% this month, the biggest for six months (November 2023 – 0.43%).

“Borrowers coming off a fixed rate mortgage this year will need to cover higher monthly mortgage repayments. Indeed, in May 2022, the average two-year fixed mortgage rate was 3.03%, and in May 2019 the average five-year fixed mortgage rate was 2.85%. It will still be cheaper for borrowers to grab a fixed mortgage now compared to sitting on a revert rate, based on average rates, and some borrowers may even consider a base rate tracker mortgage over the next two years if they are in line with economists’ predictions for the Bank of England to cut base rate this year. Consumers preparing to refinance or ready to buy their first home would be wise to seek advice to navigate the latest deals available.”