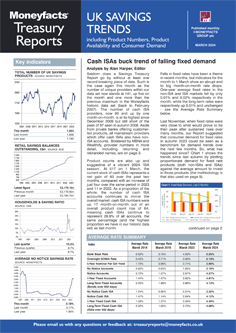

Rachel Springall, Finance Expert at Moneyfacts, said:

“Savers may be pleased to see the sizeable rate cuts to fixed bonds felt in recent months calmed during February. Month-on-month, the average rate on a one-year fixed bond fell by a marginal 0.01%, a far smaller cut than the 0.25% recorded a month prior. On longer-term bonds, the average rate rose by 0.01% after back-to-back months of relentless rate cuts. This is a positive turn of events for the fixed rate bond market, as between the start of 2024 and the start of February, the average longer-term bond fixed rate fell by a significant 0.34%, the biggest monthly drop recorded in 15 years. However, the swap rate market remains volatile, and providers will also have their own reasons to enhance or worsen their fixed rates; such moves during February resulted in a drop to the average shelf-life of a fixed rate bond to 27 days, from 39 days.

“Cash ISA rates showed a mixed bag of changes month-on-month. The average easy access ISA rate rose to its highest point in more than 15 years, but the average notice ISA rate fell. The average one-year fixed ISA rate fell by 0.02% and the longer-term ISA remained unchanged. Savers only have a couple of weeks left until the current tax-year ends, so providers are working hard to attract their deposits but will need to manage their market position carefully. The new ISA reforms will come into effect from 6 April and could encourage consumers to use Cash ISAs more. However, regardless of these reforms, savers would be wise to take advantage of both their ISA allowance and Personal Savings Allowance (PSA) to protect their cash from tax.

“Variable savings rates remained relatively resilient month-on-month, with the average easy access rate rising to 3.18%, and the average notice account rate falling to 4.27%. However, it remains the case that consumers with an easy access account from one of the high street banks may not be earning a decent return, so it is wise to check if their loyalty is being paid, and if not, switch. More than six months have passed since the market had a rise to the Bank of England base rate, but rate competition among challenger banks has not waned. There are now more savings providers than ever before on our records, giving consumers more choice and encouraging competition.”

Rachel Springall, Finance Expert at Moneyfacts, said:

“Savers may be pleased to see the sizeable rate cuts to fixed bonds felt in recent months calmed during February. Month-on-month, the average rate on a one-year fixed bond fell by a marginal 0.01%, a far smaller cut than the 0.25% recorded a month prior. On longer-term bonds, the average rate rose by 0.01% after back-to-back months of relentless rate cuts. This is a positive turn of events for the fixed rate bond market, as between the start of 2024 and the start of February, the average longer-term bond fixed rate fell by a significant 0.34%, the biggest monthly drop recorded in 15 years. However, the swap rate market remains volatile, and providers will also have their own reasons to enhance or worsen their fixed rates; such moves during February resulted in a drop to the average shelf-life of a fixed rate bond to 27 days, from 39 days.

“Cash ISA rates showed a mixed bag of changes month-on-month. The average easy access ISA rate rose to its highest point in more than 15 years, but the average notice ISA rate fell. The average one-year fixed ISA rate fell by 0.02% and the longer-term ISA remained unchanged. Savers only have a couple of weeks left until the current tax-year ends, so providers are working hard to attract their deposits but will need to manage their market position carefully. The new ISA reforms will come into effect from 6 April and could encourage consumers to use Cash ISAs more. However, regardless of these reforms, savers would be wise to take advantage of both their ISA allowance and Personal Savings Allowance (PSA) to protect their cash from tax.

“Variable savings rates remained relatively resilient month-on-month, with the average easy access rate rising to 3.18%, and the average notice account rate falling to 4.27%. However, it remains the case that consumers with an easy access account from one of the high street banks may not be earning a decent return, so it is wise to check if their loyalty is being paid, and if not, switch. More than six months have passed since the market had a rise to the Bank of England base rate, but rate competition among challenger banks has not waned. There are now more savings providers than ever before on our records, giving consumers more choice and encouraging competition.”